Consumption, Savings-definitions, draw it

Determinants of Consumption

¿ Household income-the most important

¿ Household wealth

¿ Interest rates

¿ Households’ expectations

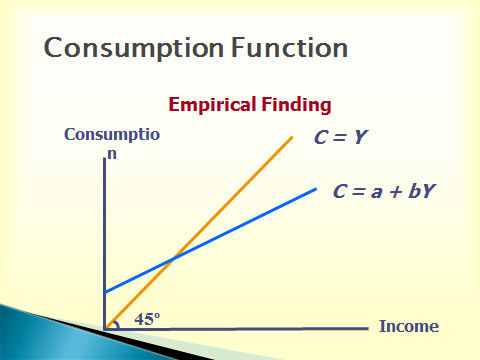

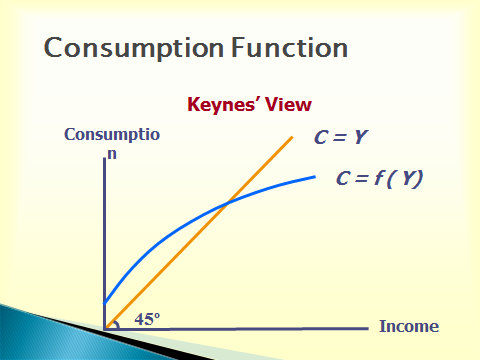

Consumption Function

¿ Keynes points out that the household consumption is closely related to the income. With the income increase, people will consume more. However, the increase of consumption is not as great as that of income.

¿ Empirical studies also reveal the close relationship between consumption and income but the increase of consumption is on the whole proportional to income.

Permanent Income Hypothesis

(Milton Friedman)

People gear their consumption to their expected lifetime average earnings more than to their current income. The central idea of the permanent-income hypothesis, proposed by Milton Friedman in 1957, is simple: people base consumption on what they consider their "normal" income. In doing this, they attempt to maintain a fairly constant standard of living even though their incomes may vary considerably from month to month or from year to year. As a result, increases and decreases in income that people see as temporary have little effect on their consumption spending.

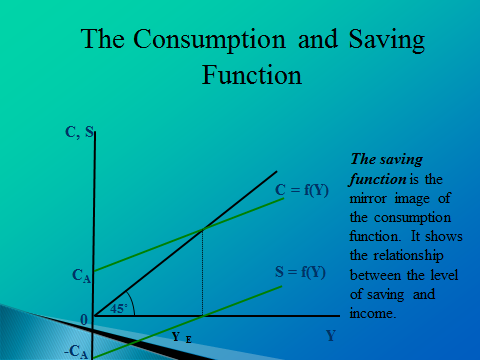

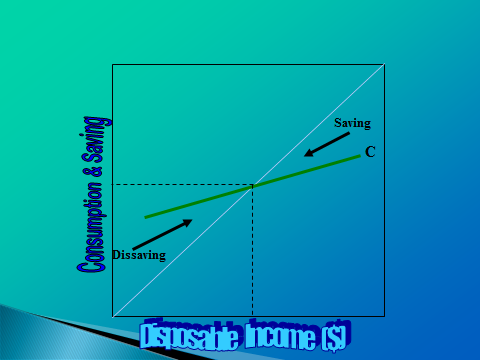

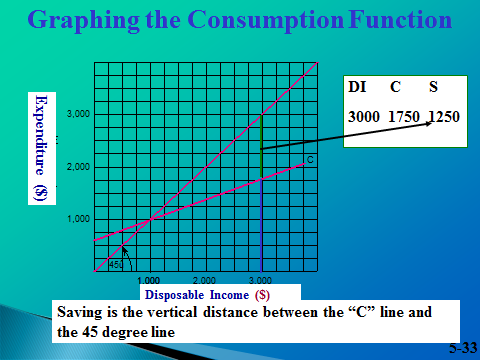

• Saving is that part of income that is not consumed. Saving equals income minus consumption: S = Y – C

The Determinants of Saving

• There is no single reason why people save

• Some spend virtually all of their disposable income

• Some spend more than they earn

• Americans now save less than 5% of disposable income

• Americans used to save 7-10% of disposable income

Autonomous Consumption versus Induced Consumption

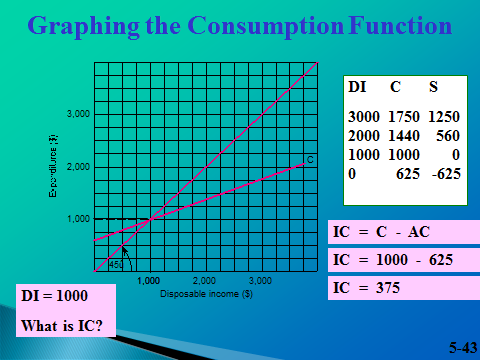

• Autonomous consumption (AC) is the level of consumption when disposable income is “0”

– It is called autonomous because it is independent of change in disposable income

• Induce consumption (IC) is that part of consumption which varies with the level of disposable income

– As disposable income rises, induced income rises

– As disposable income fall, induced income falls

• C = Autonomous C + Induced C

Investment, Investment function

TYPES OF CAPITAL

*Business fixed investment: equipment and structures businesses use to produce

*Residential investment: new housing units

*Inventory investment: goods businesses put aside in shortage to regulate

INVESTMENT: firms’ purchase of new plants, equipment, buildings, and additions to inventories

Capitalthe amount of plant, equipment, and inventories used to produce other goods, is a stock.

Depreciation (also called capital consumptionI is the decrease in the capital stock because of wear and tear and obsolescence.

Gross investmentis the total amount of investment.

Net investmentis gross investment minus depreciation. Net investment is the flow that is the amount by which the capital stock changes.

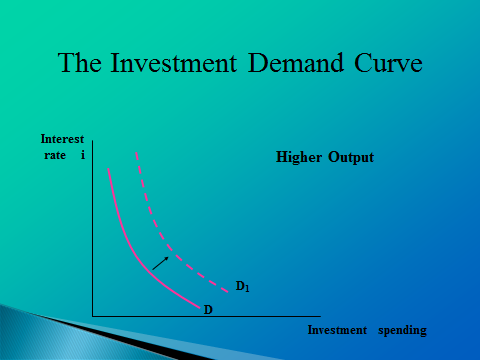

DETERMINANTS OF INVESTMENT:

• Revenues (Bevételek): an investment should bring the firm additional revenue.

• Costs: interest rate influences the costs of the investment.

• Consumer demand: the bigger the increase in consumer demand, the more investment will be needed.

Expectation: business expectation about future state of economy

For simplicity, assume two types of firms:

1. Production firms rent the capital they use to produce goods and services.

2. Rental firms own capital, rent it to production firms.

In this context, “investment” is the rental firms’ spending on new capital goods

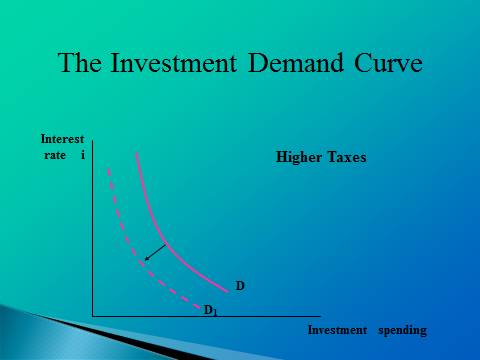

Effect of Taxes on Investment

Corporate income tax is a tax on corporate profit. An increase in the tax would discourage business investment.

Investment tax credit (A tax credit is a dollar-for-dollar reduction in the income taxes that a person or company claiming the credit would otherwise pay the federal government) is an incentive (стимул) for businesses to invest. An increase in the tax credit would encourage business investment.

Inventory Investments

Firms maintain a product inventory to “smooth” production of goods whenever consumer demand changes

Firms maintain inventories of parts and materials, like a production factor, to increase output quickly

Firms maintain inventories to avoid running out of stocks

Firms maintain inventories of parts and materials when the product requires a number of steps in production

Firms invest in inventories, which are produced goods held in storage in anticipation of later sales. Firms also stockpile raw materials and intermediate goods used in the production process. Goods held in inventories are counted for the year produced, not the year sold.

Although inventories are a relatively small portion of the overall investment sector, inventories are a critical component of changes in GDP over the business cycle. If the economy is slowing down, possibly entering a recession, the bearer of the bad news will often be an undesired accumulation of inventories. As consumers reduce their purchases, sales of goods and services slow, inventories build up, and firms slash production (laying off employees) to reduce unwanted (and costly) inventories.

7.Savings, Summarize the investing in stocks and bonds +factors that affect the rate of return on a given savings or investment

Investing

Putting your money to use in order to make money on it.

Simple Interest vs. Compound Interest

Simple – interest that is computed only on the amount saved.

Compound – interest that is computed on the amount saved plus interest previously earned.

Securities refers to bonds, stocks, and other documents sold by corporations and governments to raise large sums of money.

Investing Through Banks

Savings Account

-Simplest form of saving

-Offered by all institutions (banks, credit unions, etc.)

-Generally, a low minimum deposit is required

-Interest is low and varies from institution to institution

Certificate of Deposit

-Requires a minimum deposit for a minimum amount of time

-Interest rates are higher than a savings account

Money Market Fund-Pénzpiaci alap

-Kind of mutual fund, or pool of money, put into a variety of short-term debt (adósság) by business and government

Investing in Bonds (Kötvény)

*Bonds-Promise to pay a definite amount of money at a stated interest rate on a specified maturity date.-Lejárati dátum

*Bondholder –Kötvénytulajdonos-Individual who lends money to a corporation.

*Bond Terms:

1)Face Value (Névérték)-Amount being borrowed by the seller of the bond.

2) Coupon Rate (Kamatláb)-Rate of interest on the bond.

Types of Bonds

*Corporate Bonds

Issued by corporations (vállaltok által kibocsátott)

Used to finance buildings and equipment.

*Municipal Bonds

Issued by local and state governments.

Used to finance schools, roads, airports, etc.

*Treasury Bonds

Issued by federal government.

Known as Savings or Federal Bonds

Types:

*Series EE Bonds-Sorozatkötvények

Cost half the face value. After a specified number of years the bond becomes worth the face value.

*Treasury Bills -Kincstárjegyek

Issued for three months to one year.4, 13, and 26 week maturity

*Treasury Bonds –Kincstári Kötvények

Issued for ten or more years.

— Stocks

Buying a part of a publicly traded company

As profits increase value of stock increases

Highest potential rate of return

Highest risk

No limit on how long you have to invest or how much you could lose

Pay taxes on dividends and gains from appreciation

Available from stock brokers and online brokerages

Investing in Stocks

Stock-Share of ownership in a business.

Stock Certificate-Proof of ownership in a corporation

Market Value-Price at which a stock can be bought or sold.

Dividends (Osztalék)-Part of profits shared with stockholders.

Brokerage Firm-Sells stocks for consumers

Broker-Person who acts as a go between for buyers and sellers of securities.

Commission-Fee charged by a brokerage firm for the buying and/or selling of a security.

Stock Exchanges

*Marketplace where brokers who represent investors meet to buy and sell securities.

*Examples:

NYSE

NASDAQ

AMEX

Exchanges in San Francisco, Boston, Chicago

BÉT (Budapesti Értéktőzsde)

Stocks, or shares of stock, represent an ownership interest in a corporation. Bonds are a form of long-term debt in which the issuing corporation promises to pay the principal amount at a specific date.

Stocks pay dividends to the owners, but only if the corporation declares a dividend. Dividends are a distribution of a corporation's profits. Bonds pay interest to the bondholders. Generally, the bond contract requires that a fixed interest payment be made every six months

Rate of return

Factors determining a rate of return

*Safety

Assurance that the money you have invested will be returned to you.

*Risk - Chance of loss.

*Rate of Return (yield)

Amount of money the investment earns.

Compounding frequency is the interest computed on the amount saved plus the interest previously earned.

Rate of return (percentage of interest that will be added to you r savings over a period of time).

*Liquidity

Ease with which an investment can be changed into cash.

*Resistance to inflation

Will rate of return keep up with inflation?

*Tax considerations

Calculating Rate of Return

Rate of Return = Total Interest Earned divide by Original Deposit

Example: If you deposited $100 in account that paid $6.18 interest for one year. What is the rate of return? $6.18/$100 = .0618 = 6.18%

Savings and Economic Growth

Individual savings allow:

-Businesses to expand and create more jobs.

-Demand for goods and services to increase.

Failure to save will cause less money to be invested and the economy may slow as a result.

Savings contribute to our economic stability

Government uses savings to build highways, schools, and public services

7. Savings, Summarize other types of investments + factors that affect the rate of return on a given savings or investment

Investing Through Insurance

— Life Insurance-Életbiztosítás

— Cash-value insurance provides both savings and death benefits.

Investing in Your Future

— Annuity

— Amount of money that an insurance company will pay at definite intervals to a person who has previously deposited money with the company.

Investing Through Other Sources

— Real Estate

— Land and anything that is attached to it.

— Mortgage- Jelzálog

— Legal document giving the lender a claim against the property.

— Home Equity

— Difference between the price at which you could currently sell your house and the amount owed on the mortgage.

— Appreciation (Értéknövekedés) – general increase in value of a property.

— Depreciation (Értékcsökkenési leírás)– general decrease in value of a property.

— Types of Property

— Undeveloped Property (Land)

— Unused land intended only for investment purposes.

— Commercial Property

— Land and buildings that produce lease (lízing) or rental income.

Collectibles

— Items of personal interest to collectors.

— Rare coins, works of art, antiques, stamps, rare books, comic books, sports memorabilia, rugs, ceramics, paintings, and other items that appeal to collector and investors.

Commodities- Áruk

— Include grain (grain), livestock (állatállomány), precious metals (nemesfémek), currency, and financial instruments.

— Futures

— Commodity contract purchased in anticipation of higher market prices for the commodity in the near future.