Different Taxes That Americans Pay

1) Income Taxes are federal taxes. Some Americans pay as much as 35% of their paychecks to income taxes.

2) Business Taxes also known as corporate taxes are direct taxes levied on the profits of businesses. However, expenses can often be deducted to lowerthe amount of profits subject to taxes.

3) Property Taxesare imposed on property by reason of its ownership. They are usually paid on real estate but can also be paid on personal property, such as boats, automobiles, recreational vehicles and other business inventories.

4) Payroll Taxesare the taxes that must be deducted from wages paid to employees. Some payroll taxes include federal withholdings, disability insurance, Medicare and other state withholdings.

5) Inheritance Taxalso known the “death tax” is a tax that arises from thedeath of a taxpayer. It is imposed on the transfer of any property or asset transferred as the result of a death.

6) In the United States Capital Gains Taxesis levied on all income generated from a taxpayer’s capital gains, which are profits from the sale of an asset that was purchased at a lower price. The most common capital gains are created from the sale of stocks, bonds, and property.

7) Excise Taxes arebased on the value and on the quantity of the product being taxed. Common examples include gasoline, cigarettes, and even CD’s and DVD’s copyright owners.

8) Sales TaxesorConsumption taxes are levied at the point of purchase for specific goods and services. It is usually a percentagedetermined by the levels of governmentcharging the tax. Due to individual state and local taxes, the exact rate will vary widely by location.

9) Gift Taxis levied on the transfer of property by one taxpayer to another while receiving something with a less than equal value. Selling something at less than its full value or making an interest-free or reduced interest loan may qualify as making a gift.

10) Retirement Taxes is levied by the government to plan a taxpayer’s retirement and could be considered retirement taxes. In the United States they pay into a social security system that provides income to retired workers from the general fund. This tax is regressive as they all pay the same rate up to a specific cap. Then all income above the cap is not taxed.

11) Tariffs -An import or export tariff are paid by the movers of any good through a political border. Typically, it is used to “encourage” local businesses and “discourage” the purchase of foreign goods by increasing the price for the foreign goods.

12) Tolls are charged to drivers who cross through designated bridges, tunnels, and even some roads. They usually always paid in fixed amounts each time you drive through the restricted area. Tolls are frequently used for state projects fund but can also be used for privately funded projects.

12) Tolls are charged to drivers who cross through designated bridges, tunnels, and even some roads. They usually always paid in fixed amounts each time you drive through the restricted area. Tolls are frequently used for state projects fund but can also be used for privately funded projects.

A. Заполните следующую таблицу по образцу.

| Название налога | перевод | Налогооблагаемая база | Есть ли в России |

| Income Taxes | Подоходный налог | + | |

| Business Taxes | |||

| Property Taxes | |||

| Payroll Taxes | |||

| Inheritance Taxes | |||

| Capital Gains Taxes | |||

| Excise Taxes Sales Taxes | |||

| Gift Taxes | |||

| Retirement Taxes | |||

| Tariffs | |||

| Tolls |

Б. Вставьте в предложение пропущенное слово.

1. Russians lose as much as 13% of their paychecks to______________________.

2. When you sell stocks, bonds, and property you have to pay _______________.

3. Federal withholdings, disability insurance, Medicare are included into __.

4. ___________________is the tax that is levied on gasoline, cigarettes etc.

5. Business taxes are directly levied on the profits of______________, not people.

6. ___________are fixed amounts that you pay when driving through the restricted area.

7. ____ ______________________________is also known as Consumption taxes.

8. This is the tax that Americans pay into a social security system that provides income to retired workers from the general fund. It is called _________________.

9. The “death tax» is also known as ____.

10. If you have real estate you have to pay _______________________________.

11. When you move goods through a political border you have to pay __________.

12. When you transfer your property to another taxpayer either for nothing or a less than equal value in return you have to pay _______________________________.

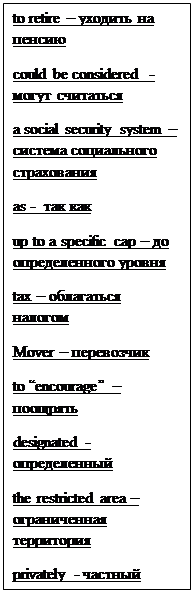

Учим термины

116. Income Taxes - подоходный налог

117. Paychecks –расчетная ведомость

118. Business Taxes /corporate taxes – налог на предпринимателя/ налог на прибыль корпораций

119. To levy/impose direct taxes – облагать прямыми налогами

120. The profits of businesses – прибыль предприятий

121. To deduct expenses - вычитать/удерживать издержки/затраты

122. Property Taxes–налог на недвижимое имущество

123. Ownership – собственность, владение

124. Real estate - недвижимость

125. Personal property – личная собственность

126. Payroll Taxes–налог, взимаемый с заработной платы

127.Wages/salary – зарплата рабочих /оклад служащих

128. Employee – работник по найму

129. Employer – работодатель

130. Withholdings – удержания

131. Disability insurance – страхование по нетрудоспособности

132. Medicare – бесплатная медицинская помощь

133. Inheritance Tax–налог на наследство

134.Taxpayer - налогоплательщик

135. Capital Gains Taxes- налог на увеличение рыночной стоимости капитала

136. Income - доход

137. Stock - ценные бумаги, запас, резерв

138. Bond – облигация, долговое обязательство

139. Excise Taxes - акцизы

140. Quantity of the product – качество продукта

141. Sales Taxes or Consumption taxes - налог с оборота/ налог на потребление

142. State and local taxes – государственные и местные налоги

143. Tax rate - ставка налогообложения

144.Gift Tax-налог на дарение

145.Interest-free - беспроцентный

146. Retirement Taxes–налоговые поступления для погашения государственного долга, налоговые пенсионные поступления

147.A social security system – система социального обеспечения

148. Tariffs-тарифы

149. Tolls - пошлины